How Does "cibil_loan_recommendation" Smart Skill Work

- Getting Started

- Bot Building

- Smart Agent Chat

- Conversation Design

-

Developer Guides

Code Step Integration Static Step Integration Shopify Integration SETU Integration Exotel Integration CIBIL integration Freshdesk KMS Integration PayU Integration Zendesk Guide Integration Twilio Integration Razorpay Integration LeadSquared Integration USU(Unymira) Integration Helo(VivaConnect) Integration Salesforce KMS Integration Stripe Integration PayPal Integration CleverTap Integration Fynd Integration HubSpot Integration Magento Integration WooCommerce Integration Microsoft Dynamics 365 Integration

- Deployment

- External Agent Tool Setup

- Analytics & Reporting

- Notifications

- Commerce Plus

- Troubleshooting Guides

- Release Notes

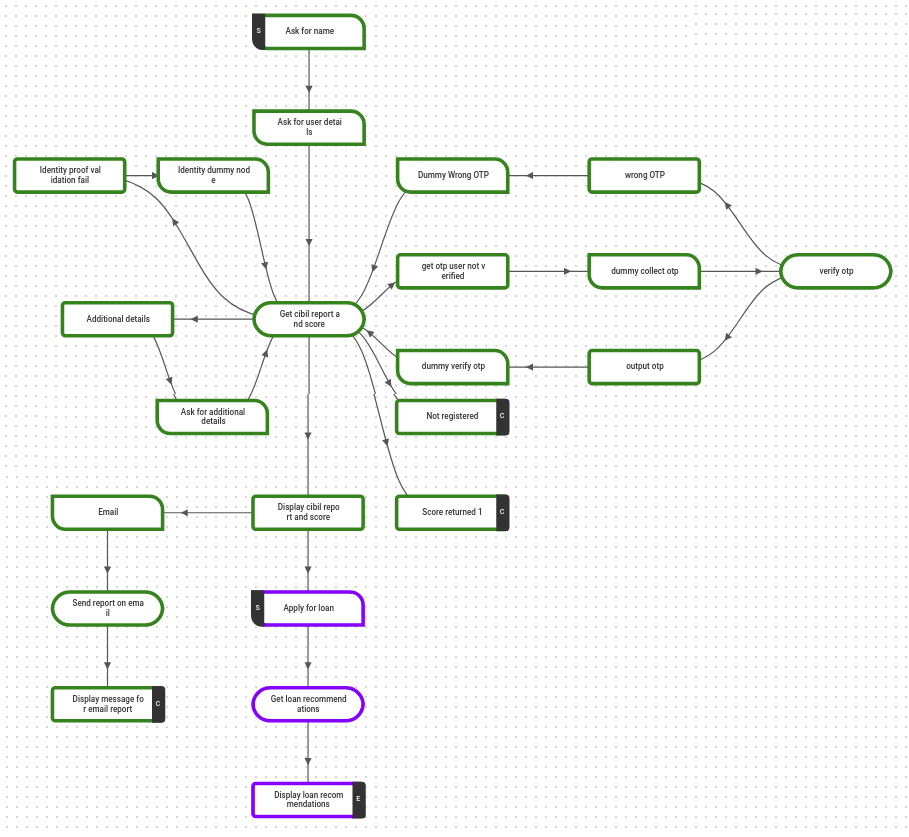

When you add the "cibil_loan_recommendation" Smart Skill on your bot, you will be able to see the below graph structure of Steps added on your bot. Now, let us understand the working of this graph structure in detail.

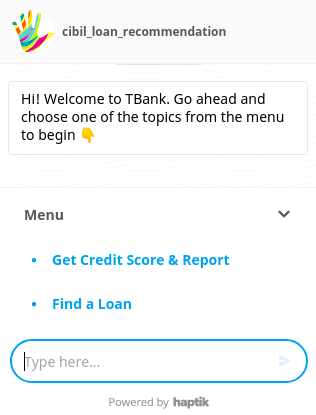

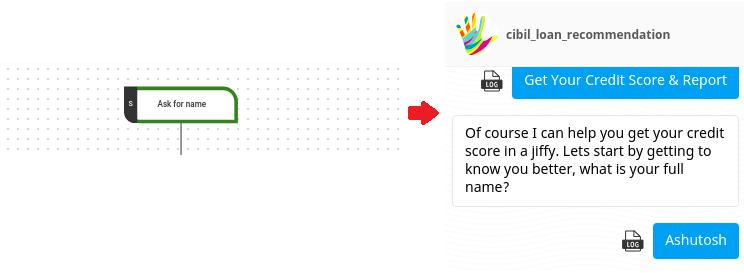

At the beginning of the flow, when the user tries to fetch his CIBIL scores, he needs to first select an option from the given options as shown below.

Once the user selects "Get Credit Score & Report" the flow of conversation will be as follows.

Step 1: It starts with the "Ask for name" Step, where the bot asks the user to enter his name.

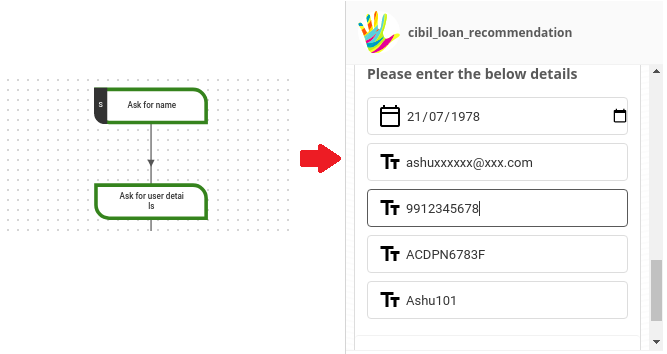

Step 2: After the user has entered his name, the bot then moves to the "Ask for user details" Step which has a form as shown in the image below.

Step 3: Once the user has entered all the required details in the form, there are 3 possible outcomes at this point.

Step 3: Once the user has entered all the required details in the form, there are 3 possible outcomes at this point.

-

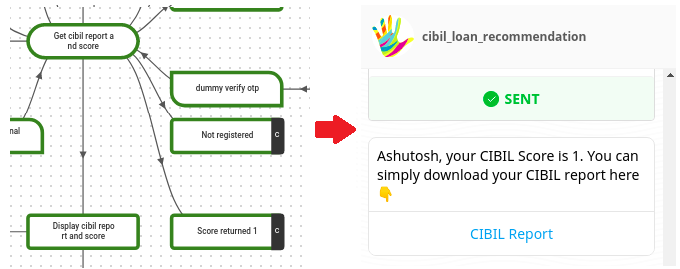

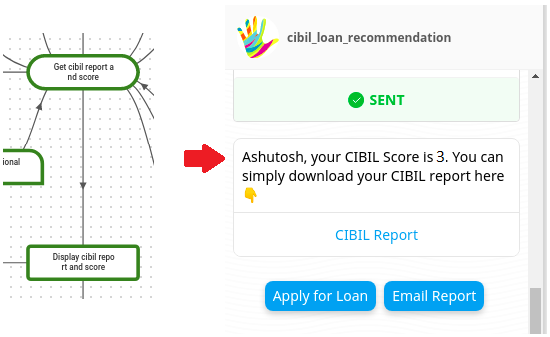

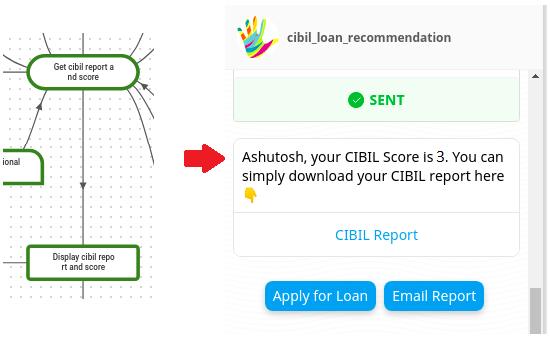

Existing User: If the user is an existing user, then the bot will move to the "Get cibil report and score" Step, and right away display his CIBIL score as a response. This response comes from the "Display cibil report and score" Step.

-

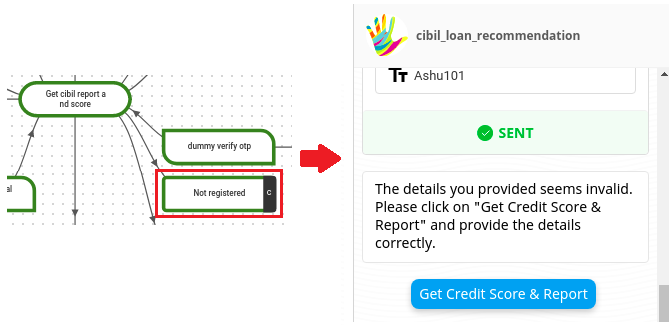

Non-Registered User: If the user is a non-registered user, the flow will move to the "Not registered" Step where the Bot will inform the user to register first.

-

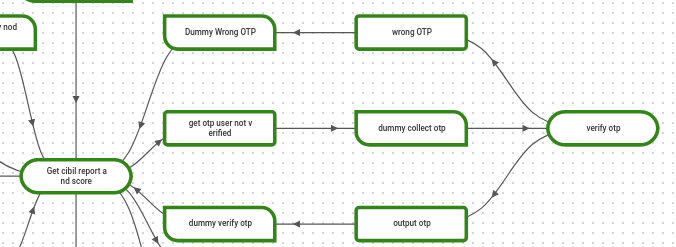

Registered New User: If the user is a new registered user, the bot will ask an OTP to verify the user and it will move to the "get otp user not verified" Step.

- If the OTP user enters is right, the user will get verified, and the flow will move to the "get cibil report and score" Step.

- If the OTP user enters is wrong, the user won't get verified and the flow will move back to the "get cibil report and score" Step and again the user will be asked to enter the right OTP.

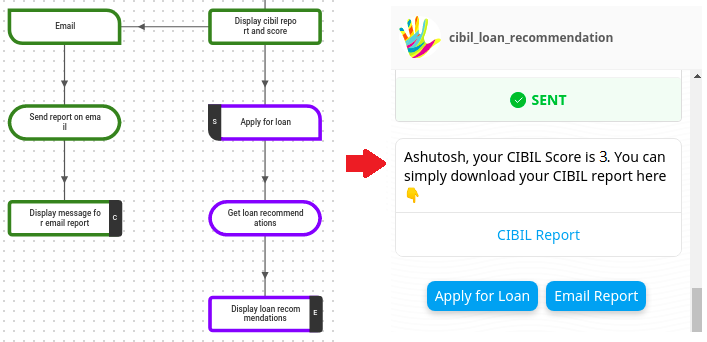

Step 4: Once the user has received the CIBIL Score, they can then apply for a loan, or choose to get their report over email, as shown in the image below.

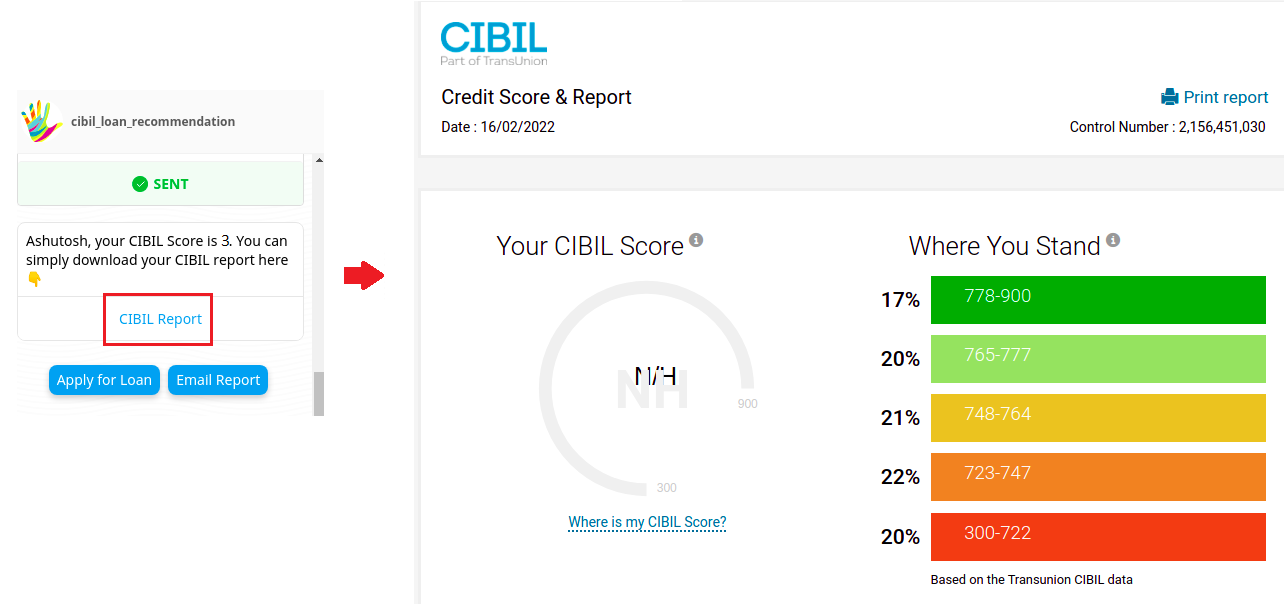

The user can also select the CIBIL Report button, which will take them to a link that will display a detailed report of their CIBIL data, as shown below.